As the holiday season approaches, many of us look forward to celebrating with loved ones, shopping online, giving thoughtful gifts — and yes, even the busyness and hustle of the season. Unfortunately, that same energy makes this time of year especially attractive to scammers. In 2025, new tools powered by artificial intelligence are giving fraudsters more ways to deceive, impersonate, and take advantage of people. We’re here to help you stay ahead — both with what to look out for and the many ways we’re protecting you.

What’s Evolving: New Scams, Fueled by AI

Here are a few of the latest threat types to watch:

- Synthetic ID fraud

Fraudsters are blending real and fake personal data to create entirely new identities or identity documents. These synthetic identities can be used to open credit, take out loans, or access services — which often go undetected for long periods. - Deepfake impersonations

With advances in AI, scammers now produce convincing video, audio, and images that mimic real people — sometimes even people you know — to create urgency or trust. You may get a phone call or video message supposedly from a family member in crisis or from someone claiming to be from your financial institution using a voice or face that sounds familiar to you. - Smarter phishing, investment & romance scams

AI is helping scammers craft messages that are more personalized and believable. That includes messages about fake gift cards, package delivery delays, holiday deals that are “too good to be true,” or investment schemes pushed through social media or WhatsApp groups. Scammers will often build trust over weeks or months before asking for significant amounts of money. - Real-time payment and verification fraud

Fraud attempts are increasingly occurring during account setup or identity verification phases. In many cases, by the time someone realizes they’ve been tricked, the money has already moved. The rise in digital banking also means more verification steps are automated — and these can be manipulated via AI.

How These Threats Could Hit You During the Holidays

- Emotional leverage & urgency: Many scams work by creating fear (a family emergency) or FOMO (limited-time deals). Deepfake voice calls or texts pretending to be a loved one can be especially persuasive.

- Holiday shopping & online deals: Between massive deals (Black Friday/Cyber Monday) and last-minute gift purchases, people are more likely to click links, buy from unfamiliar sellers, or scroll quickly without checking carefully.

- Charitable giving: Scammers often pose as charities sending donation requests — especially at the end-of-year or due to local crisis events. AI can make fake solicitations appear more legitimate.

- Busy schedules: More distractions, more devices, more transactions mean less time to double-check. A fraudster’s well-timed message (e.g. “verify your shipping address” via QR code) might slip by.

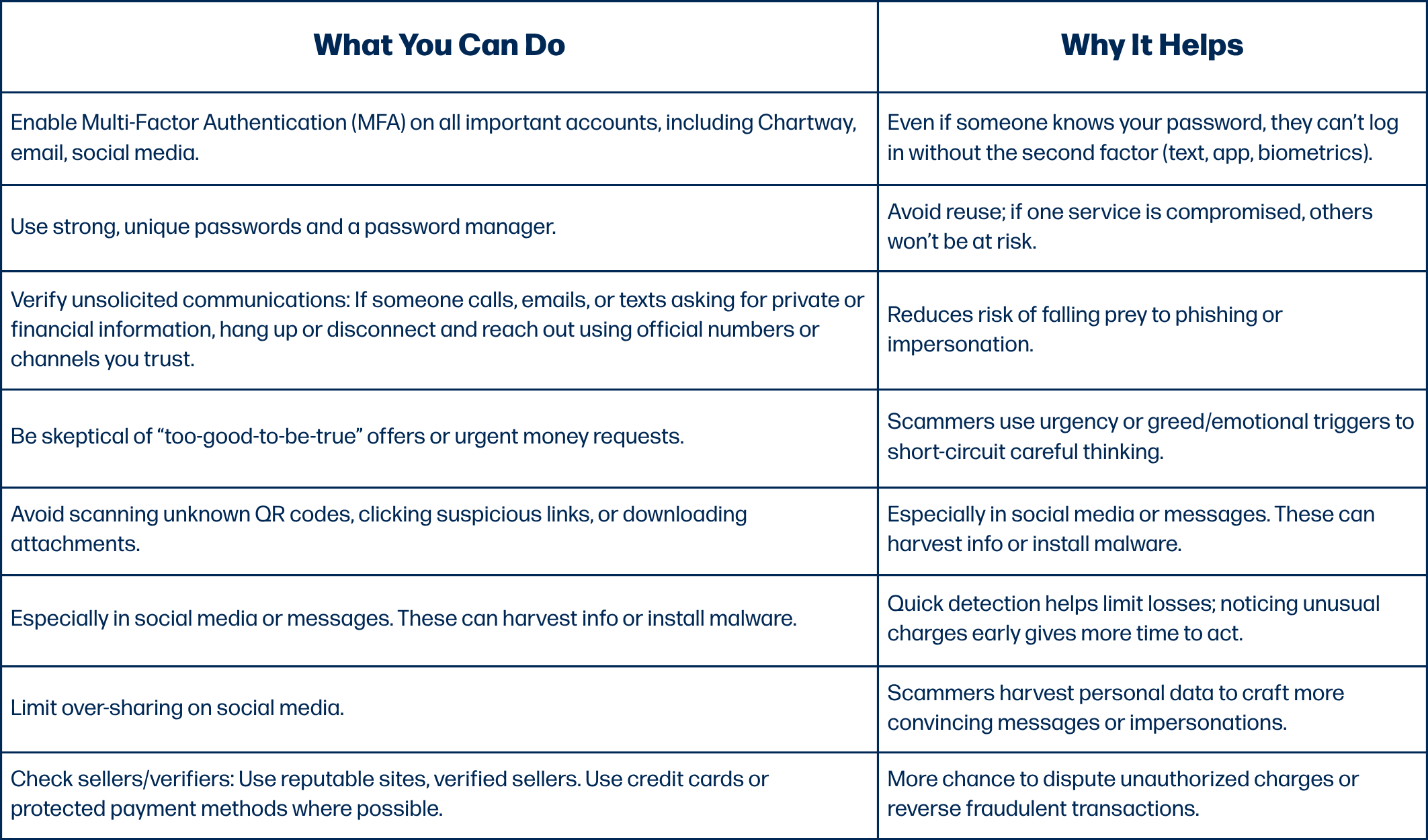

Practical Steps You Can Take to Stay Safe

To prepare yourself, we encourage you to take a self-paced, 20-minute online course from our partner, Greenpath. In it, you’ll learn how to spot scams and better protect yourself from identity theft.

What Chartway Does to Protect You

At Chartway, we take multiple layers of security seriously. Here are some of the ways we help keep your finances safe:

- Fraud & Security Center: We provide educational resources and alerts about common threats. You’ll see reminders about how Chartway operates (for example, we will never contact you directly to ask for your password, PIN, Social Security Number, etc.).

- Secure Payments & Encrypted Online Banking: We use strong encryption to protect information when you log in, pay, or transfer money.

- Multi-Factor Authentication (MFA) options for online banking and member accounts to add an extra layer of protection. (If you haven’t set it up yet, we strongly encourage it.)

- Monitoring & Alerts: We pay attention to unusual or suspicious account activity. If something seems off, we’ll work to alert and assist you.

- Member Outreach & Education: We publish fraud prevention guides (in the blog, via email) especially ahead of high-risk periods (holidays, big shopping days). Our goal is to inform you before a scam reaches you.

What to Do If You Think You’ve Been Scammed

If you suspect fraud — don’t wait. Here are your action steps:

- Contact Chartway as soon as possible. Freeze or block compromised accounts or cards.

- Report the incident to local law enforcement if appropriate.

- Document everything: what happened, when, what messages/calls/emails etc.

- Change passwords, enable MFA on affected accounts.

- Monitor credit reports. Consider placing a freeze or fraud alert if identity theft is involved.

- Reach out for help — we’re here. Chartway’s team can guide you through recovery.

Final Word

Technology keeps evolving — and so do the tools scammers use. This holiday season, adding a little extra caution, using the security tools available, and staying alert can make all the difference. At Chartway, protecting your peace of mind is part of our promise. We want your holidays to be filled with joy, not worry.

Stay safe. Shop smart. And let’s finish the year on a strong, secure note.